Agent Remittance Software Solution

Our Agent Remittance Solution empowers businesses to build a wide-reaching money transfer network through trusted agents who act as local cash-in and cash-out points.

This model allows customers to conveniently send and receive money using physical agent locations while the business manages everything seamlessly through a centralized platform.

Ensuring security and compliance for remittance by agent over the counter

Our industry leading cloud based money transfer platform uses intelligent technologies to ensure optimum security, enforce KYC checks, AML compliance and provide precise monitoring of agent accounts. ARM provides full records management for a network and hierarchy of agents and super agents.

ARM makes your Agents really effective and always compliant. Scalable, modular, multi-channel approach – supporting your individual distribution and growth strategy. Integrates 3rd party delivery networks, broadening your capability. Integrated with COM to mitigate fraud and risk. ARM easily and flexibly manages all types of agent fees and commissions, even with a super-agent hierarchy. It manages the complete transaction lifecycle via the agent (create, view, approve, pay-out).

Key Features

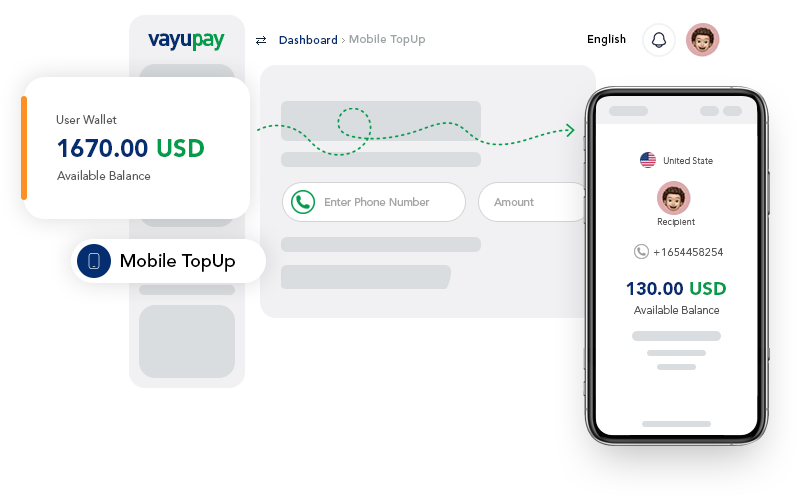

- Agent Portal / Login

- Secure login for each agent.

- Cash pick-up (collecting money from customers).

- Cash delivery (payout to recipients).

- Transaction tracking and history view.

- Commission earnings dashboard

Admin Portal

- Register and onboard new agents with ease.

- Assign commission structures, transaction limits to each agent.

- Full control and visibility over all agent activities.

- Role-based access for staff.

- Real-time reporting on transactions, settlements, and commissions.

- Fraud detection and compliance monitoring (AML/KYC ready).

- Settlement management between agents and business.

- Monitor agent performance in real-time.

- Security & Compliance

- Encrypted transactions and secure logins.

- Supports KYC/AML compliance for regulated environments.

- Audit logs for transparency.

Business Benefits

- Expand your remittance reach without opening physical branches.

- Enable cash-to-cash, cash-to-digital, or digital-to-cash flows.

- Increase revenue through commission-based agent partnerships.

- Drive growth by leveraging local trust and accessibility.

FAQs

How does the agent portal work?

Each agent gets a secure login where they can process cash collections, make payouts, check transaction history, and track their commission earnings.

What can I do with the admin portal?

The admin portal gives you complete control – onboard new agents, set transaction limits, define commissions, monitor transactions in real time, manage settlements, and ensure compliance with AML/KYC rules.

Is the system secure?

Yes. All transactions are encrypted, and the system includes multi-level authentication, fraud detection, and audit logs to ensure security and compliance.

Can I set different commission structures for agents?

Absolutely. You can define custom commission rates based on agents, or transaction volumes.

Can this system handle both domestic and international remittances?

Yes. It supports cash-to-cash, cash-to-digital, and digital-to-cash flows, making it flexible for both domestic and cross-border transfers.

Can the solution be customized for my business?

Yes. The solution is scalable and fully customizable to match your business model, and regional requirements.

Accelerate your business with our digital financial solutions?

We will be pleased to help you to bring for your dream business plan to real world.